Pension Plans

Pension during your old age. These policies are most suited for senior citizens and those planning a secure future, so that you never give up on the best things in life.

Pension Plans are known as retirement plans that require you to make contributions into a pool of funds set aside for your benefit in future. This pool of fund is invested on your behalf, and the earnings on the investment generate income on your retirement.

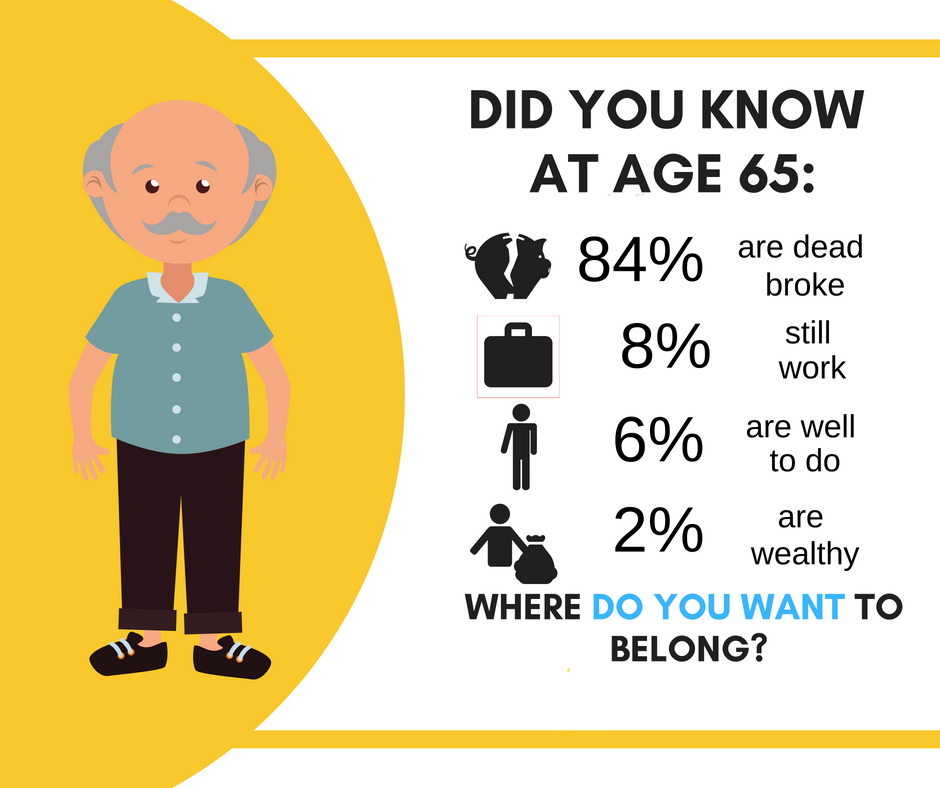

We all work hard and save money for one of the key stages of life i.e. ‘Retirement’. It is essential to have enough savings post your retirement in order to sustain your lifestyle the way you’ve always been living. Therefore, “Pension Plan” plays a very important role in your financial planning.

Everyone would like to continue living a lifestyle the way you have been living during your working life, which is why Pension Plans are also known as ‘Retirement plans’. A certain amount of your current income is transferred and stored for your future by your employer. This amount is then given to the employee as pension fund on his/her retirement.

Take your first step towards building the life you always dreamed of…

For your retirement plan, there are heaps of pension plans available in the market. These plans are different from each other. Their benefits, features, exclusions etc. are different too. Pension plans are basically an investment or saving tool to provide for your future retirement needs.

All the pension plans are divided into two parts.

- The first part is accumulation where you (insured) pays the premium.

- The second part is distribution.

Here, you are paid a regular income through an annuity plan after your retirement. Annuity Plan is a type of insurance which starts paying you an income from the start as per the options chosen by you.

The benefit of choosing this investment option i.e. pension plan, is that it provides financial security and stability during one’s golden years. Individuals would not have to compromise on their standard of living after retiring from their respective jobs.

When you consider the possibility of investing in life insurance, one of the first questions you’ll be faced with is this – who should buy life insurance? The answer to this question focuses on the financial situation of the investor. Typically, anybody who has a financial dependent would benefit from investing in life insurance. Financial dependents could include children, a spouse, a sibling, or even dependent parents.

Another category of people who should buy life insurance includes investors who want to enjoy the benefits of tax savings coupled with long-term capital appreciation. A life insurance policy is one of the few investment options that offers both these advantages. Aside from these benefits, there are many other ways in which life insurance can help the investor.

To ensure a worry-free, quality retired life, one must ensure to plan for retirement well in advance. Retirement planning deals with identifying income sources, estimating the expenses that are going to arise, executing a savings program and managing risk and assets. It must begin long before the individual retires, and the sooner he or she starts, the better. Financial experts often recommend people to begin retirement planning from the day they start earning. Starting early gives them more time for their wealth to grow. A well-chosen retirement plan can help one rise above inflation. Individuals are advised to make use of a retirement calculator to get an idea about how much they will need to save for the kind of retirement they wish to have.

Life insurance works best when purchased as part of a carefully thought-out financial plan. We make sure you buy life insurance that best fits your need and requirement!