Money Back Plans

Money back plans offer a true amalgam of insurance and investment to secure your family financilly.

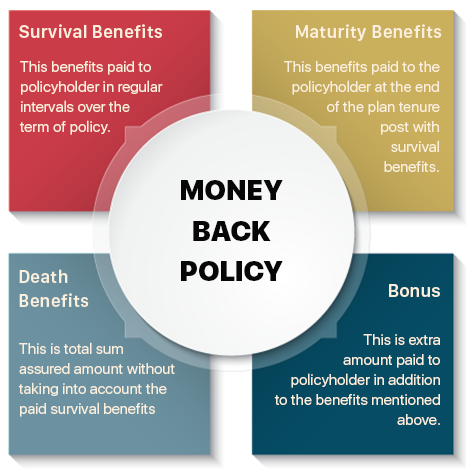

The money-back policy from Life Insurance Corporation in India is a popular insurance policy. It provides life coverage during the term of the policy and the maturity benefits are paid in installments by way of survival benefits in every 5 years. The plan is available with 20 years and 25 years term.

Money back plans protect your family’s financial interests from circumstances such as death or critical illness of the policyholder. Periodic payouts create wealth for meeting financial commitments at key stages in life.

This policy is suitable for risk-averse individuals who wish to save through an insurance plan and also maintain liquidity throughout. In case of death of the insured person, the nominee gets the entire sum assured and the survival benefits are not deducted.

LIC’s New Money Back Plan-20 years is a participating non-linked plan which offers an attractive combination of protection against death throughout the term of the plan along with the periodic payment on survival at specified durations during the term. This unique combination provides financial support for the family of the deceased policyholder any time before maturity and lump sum amount at the time of maturity for the surviving policyholders. This plan also takes care of liquidity needs through its loan facility.

Take your first step towards building the life you always dreamed of…

In a money back plan, the insured person gets a percentage of sum assured at regular intervals, instead of getting the lump sum amount at the end of the term. It is an endowment plan with the benefit of liquidity.

When you consider the possibility of investing in life insurance, one of the first questions you’ll be faced with is this – who should buy life insurance? The answer to this question focuses on the financial situation of the investor. Typically, anybody who has a financial dependent would benefit from investing in life insurance. Financial dependents could include children, a spouse, a sibling, or even dependent parents.

Another category of people who should buy life insurance includes investors who want to enjoy the benefits of tax savings coupled with long-term capital appreciation. A life insurance policy is one of the few investment options that offers both these advantages. Aside from these benefits, there are many other ways in which life insurance can help the investor.

Life insurance works best when purchased as part of a carefully thought-out financial plan. We make sure you buy life insurance that best fits your need and requirement!