Lic Insurance Policy - Plans

LIC envisages your individual insurance needs and renders plans that suit you best. The dual advantage of protection and savings, integrated with financial assistance keep you insured lifelong.

Endowment Plans

Endowment plan is a life insurance policy which provides you with a combination of both i.e.: an insurance cover, as well as an savings plan.

Money Back Plans

A Money back policy is a type of that offers policyholders Survival Benefits as well as investment opportunities in addition to Maturity Benefits.

Whole Life Plans

A whole life insurance policy or permanent life insurance provides life coverage until the death of the life assured.

Children Plans

Child plans basically help in financial planning for your child’s future needs at the right age. As a parent you can secure your child’s future

Term Insurance

Term insurance is a type of life insurance that provides coverage for a specific period of time or years. Term Insurance policies provide high life cover at lower premiums.

Pension Plans

Pension plans are pension during your old age. These policies are most suited for senior citizens and those planning a secure future.

Health Plans

Health Insurance is a type of insurance that offers coverage to the policy holder for medical expenses in case of a health emergency.

Ulip Plans

ULIP (Unit Linked Insurance Plan). is a type of Insurance, which combines the benefits of protection and saving in a single plan.

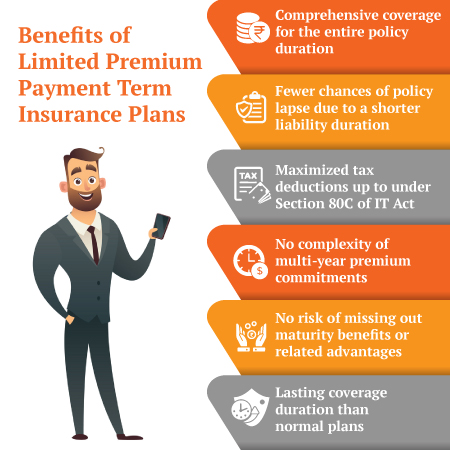

Single Premium Plans

A single premium policy is a type of life insurance policy wherein a lump sum is paid as premium instead of the yearly, quarterly or monthly form of premium payment.

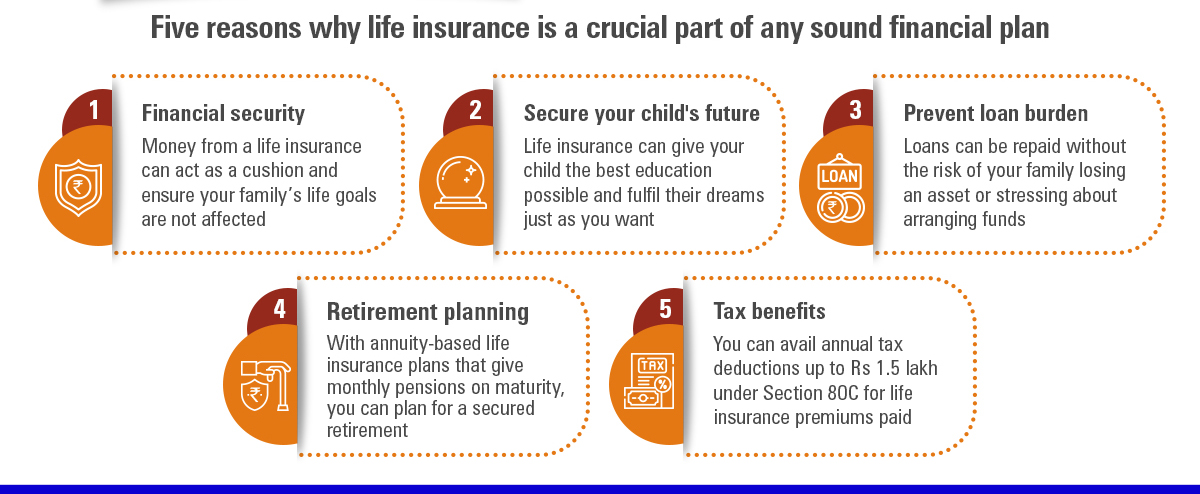

Benefits of life insurance policy

life insurance and life insurance plans are an absolute necessity today. life insurance is a risk minimization and protection tool that can help insured and their dependents in multiple ways while dealing with a variety of life events. By understanding the key features and benefits of a life insurance policy, you can make an informed decision.

01. life risk cover

Life insurance policy protects you with high life risk cover that keeps you and your family protected from any unexpected event.

02. Return on investment

Life insurance scheme yield better returns and bonuses when compared to other investment alternatives.

03. Tax Benefits

Section 80C of investment act, all the life insurance policies are subject to rebate.

04. Loan Options

All life insurance policies offers to take the policy loans.

05. Life Stage Planning

Aids you in life stage planning where you can plan your life’s financial goal as per your convenience.

05. Assured Income Benefits

You and your family can stay secure as you can get assured income in regular intervals.

Why Life Insurance? - A Case Study

Close your eyes for a minute and think about what would happen if you had an unexpected event in your life.

Would your loved ones have enough cash on hand to get through the next few months?

How about the next five years? Ten years?

Would they face the possibility of losing their home?

Would your kids, if you have them, still be able to go to college?

When you have a family to support, questions like these make it obvious that, yes, life insurance is important.

However, most people still wonder if it’s worth the expense. After all, who wants to shell out their hard-earned money to pay for something you hope you never use?