Ulip Plans

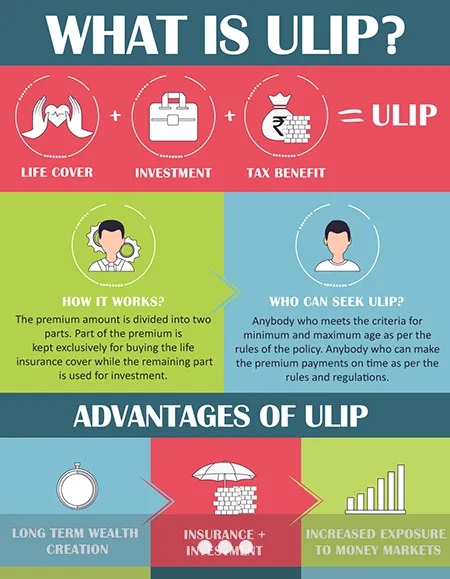

Unit Linked Insurance Plan (ULIP) is a mix of insurance along with investment.

Unit Linked Insurance Plan (ULIP) is a mix of insurance along with investment. From a ULIP, the goal is to provide wealth creation along with life cover where the insurance company puts a portion of your investment towards life insurance and rest into a fund that is based on equity or debt or both and matches with your long-term goals. These goals could be retirement planning, children’s education or another important event you may wish to save for.

When you make an investment in ULIP, the insurance company invests part of the premium in shares/bonds etc., and the balance amount is utilized in providing an insurance cover. There are fund managers in the insurance companies who manage the investments and therefore the investor is spared the hassle of tracking the investments.

ULIPS allow you to switch your portfolio between debt and equity based on your risk appetite as well as your knowledge of the market’s performance. Benefits like these which offer investors the flexibility of switching is a huge factor contributing to the popularity of these investment instruments.

Take your first step towards building the life you always dreamed of…

Why you should invest in ULIPs?

Life cover: First and foremost, with ULIPs you get a life cover coupled with investment. It offers security that a taxpayer’s family can fall back on in case of emergencies like the untimely death of the taxpayer, etc.

Income tax benefits: Not many are aware that the premium paid towards a ULIP is eligible for a tax deduction under Section 80C. Additionally, the returns out of the policy on maturity are exempt from income tax under Section 10(10D) of the Income-tax Act. This is a dual benefit that you can claim with this policy.

Finance Long Term Goals: If you have long-term goals like buying a house, a new car, marriage, etc., then ULIP is a good investment option because the money gets compounded. As a result, the net returns are generally more. This stands true even if you want to exit after the 5 year lock-in period in comparison to not having invested the amount at all and retaining it in a savings account or in the form of an FD. But, under ULIP, the mantra is to always keep the policy going for a longer time horizon to reap the best out of it.

The flexibility of a portfolio switch: As already mentioned, ULIPS are usually designed in a way that they allow you to switch your portfolio between debt and equity based on your risk appetite as well as your knowledge of how the market is performing. Insurance companies, on the other hand, allow a very few numbers of switches free of cost.

When you consider the possibility of investing in life insurance, one of the first questions you’ll be faced with is this – who should buy life insurance? The answer to this question focuses on the financial situation of the investor. Typically, anybody who has a financial dependent would benefit from investing in life insurance. Financial dependents could include children, a spouse, a sibling, or even dependent parents.

Another category of people who should buy life insurance includes investors who want to enjoy the benefits of tax savings coupled with long-term capital appreciation. A life insurance policy is one of the few investment options that offers both these advantages. Aside from these benefits, there are many other ways in which life insurance can help the investor.

Life insurance works best when purchased as part of a carefully thought-out financial plan. We make sure you buy life insurance that best fits your need and requirement!